Startup Fundamentals

Notes on ABCs of Startups.

###Points to Remember for New Entrepreneurs:

- >

Passion for Solving a Problem: To be a successful entrepreneur, you need to be passionate about solving a problem.

- >

Unique Insights: The odds of a startup succeeding are always higher if the founders have unique insights into the problem space—or domain expertise—in which their startup will operate.

- >

Up-front Investment: Almost all startups require an up-front investment in product and market development before meaningful revenues start to flow. Technically capable founders might have a slight advantage over non-technical founders. They can spend their time building the product, rather than having to spend cash to pay an external developer to build it for them.

- >

Thriving in Uncertainty: A startup is one of the most uncertain business environments in which you can place yourself. To be successful as a startup founder, it's critical that you're not just comfortable with uncertainty, but that you thrive in this dynamic environment.

- >

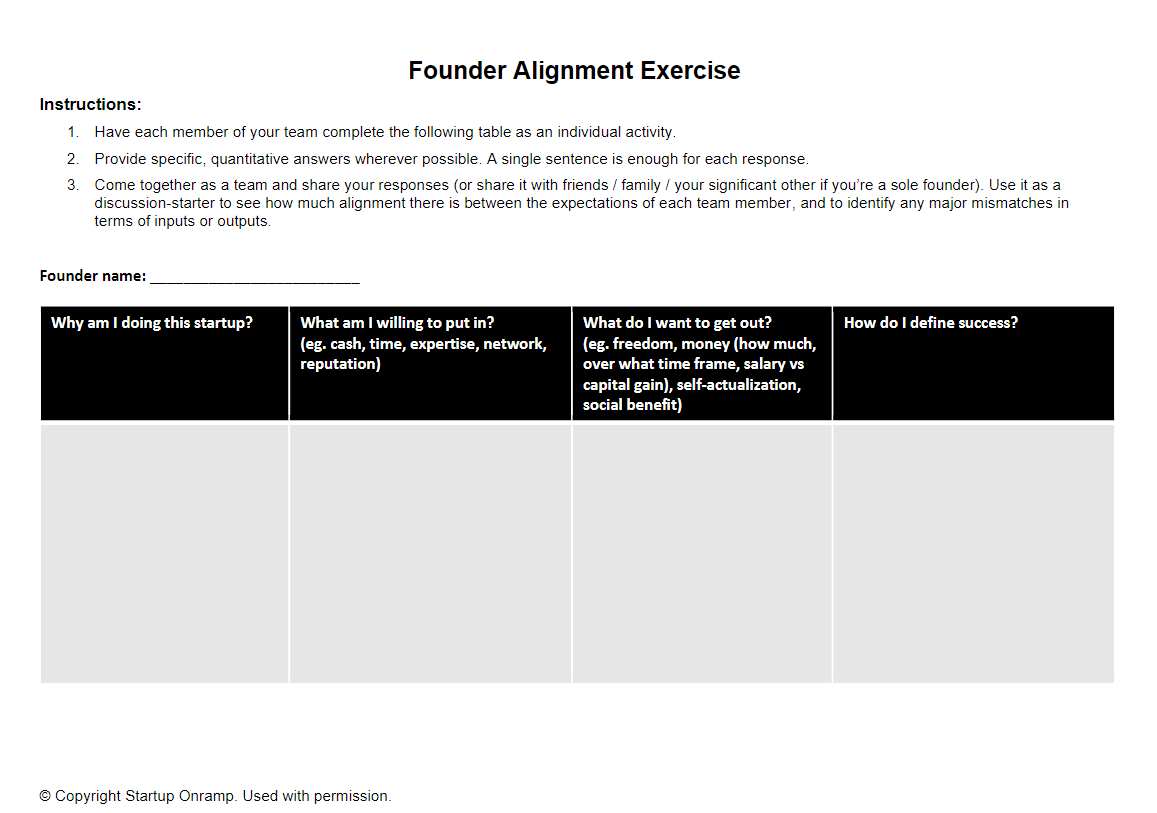

Misaligned Expectations Among Cofounders: Misaligned expectations among cofounders can lead to a loss of team cohesion. This is one of the most common causes of startup failure, particularly if it occurs early in the startup's life.

Founder_alignment_exercise - >

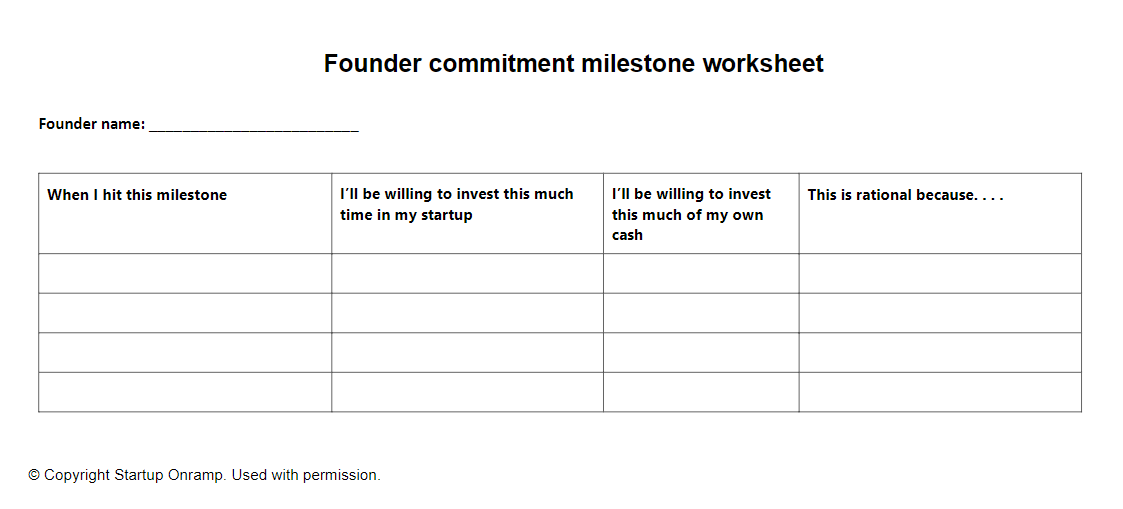

Founders’ Commitment: At some point, founders need to make the decision to step back from other work in order to focus exclusively on building their startup. However, it's a common myth that startup founders should commit full-time to their startup from the beginning.

Founder_commitment_milestone

###Traits for a Successful Startup:

- >Based on a non-obvious idea

- >Founded by the right team

- >Addresses intense customer pain

- >Has a scalable business model

- >Represents a large market opportunity

- >Benefits from advantageous timing

- >Takes advantage of market tailwinds

- >Has an inherently shareable product

- >Has a business model based on recurring revenues

###Revenue Model:

A revenue model is a strategy for how to:

- >Assign value to your product or service.

- >Target customers to buy your product or service.

- >Determine what to charge those customers.

- >Deliver the value of your product or service in a way that yields increasing sales.

Revenue Model 1: Usage

- >Customers pay based on the frequency or volume at which they use or consume your product.

Revenue Model 2: Subscription

- >Customers sign up for your product. In return for ongoing use, they pay you a recurring subscription fee. This type of delivery is known as software as a service (SaaS). The fee can be annual, quarterly, monthly, or weekly.

Revenue Model 3: Direct Sales

- >Make sales by directly contacting potential customers (outbound sales) or enabling customers to contact you directly (inbound sales).

Revenue Model 4: Commission

- >Get paid a commission from a set fee or a percentage of the transaction value every time a transaction takes place.

Revenue Model 5: Transactional

- >Make one-off sales and get paid a set price for each transaction.

Revenue Model 6: Service Delivery

- >Deliver a service in-person or online and get paid an agreed amount or a fee based on dollars per unit of time.

Revenue Model 7: Rental

- >Get paid for renting a physical product to a customer. Can be on a flat fee per-use basis or based on time or distance.

Revenue Model 8: Licensing

- >Get paid a license fee for granting another company the right to use your intellectual property (IP) for an agreed purpose.

Revenue Model 9: Channel

- >Indirect sales made by third parties that you appoint as agents or resellers.

Revenue Model 10: Advertising

- >Sell advertising space to companies that want to promote their product or service.

###Naming & Branding:

Choosing a great name for your startup is hard. It can seem like all the good names are taken, and registering a domain for your company can feel like an impossible task. However, a great name makes it easy for customers to find you, talk about you, and refer other customers.

Good startup names have the following eight attributes:

- >Simple

- >Memorable

- >Easy to spell

- >Easy to say

- >Safe in other languages

- >Future-proof

- >Available as a .com domain

- >Free of infringements on existing trademarks

###Personal Branding:

When you're a founder, your personal brand can add significantly to your company's credibility. It can help you to engage more effectively with potential customers, investors, partners, and the media.

- >Create a professional LinkedIn profile

- >Get some decent photos

- >Have your biography on the company website

- >Have a presence on social media

- >Write blog posts relevant to your company or industry

- >Become a great storyteller

- >Seek out media opportunities

- >Get media trained

###Building A Team:

It's important to consider the value of teams versus sole founders. Startups are often started by a sole founder. But before long, most sole founders realize that having a team is critical to the success of their company. Hiring a team doesn't just help manage the volume of work, but also helps tap into a broad range of skills and perspectives. Being part of a team also provides moral support.

Attributes of successful startup teams:

- >Curiosity

- >Domain knowledge

- >Bias toward action

- >Determination

- >Optimism

- >Open-mindedness

- >High emotional intelligence

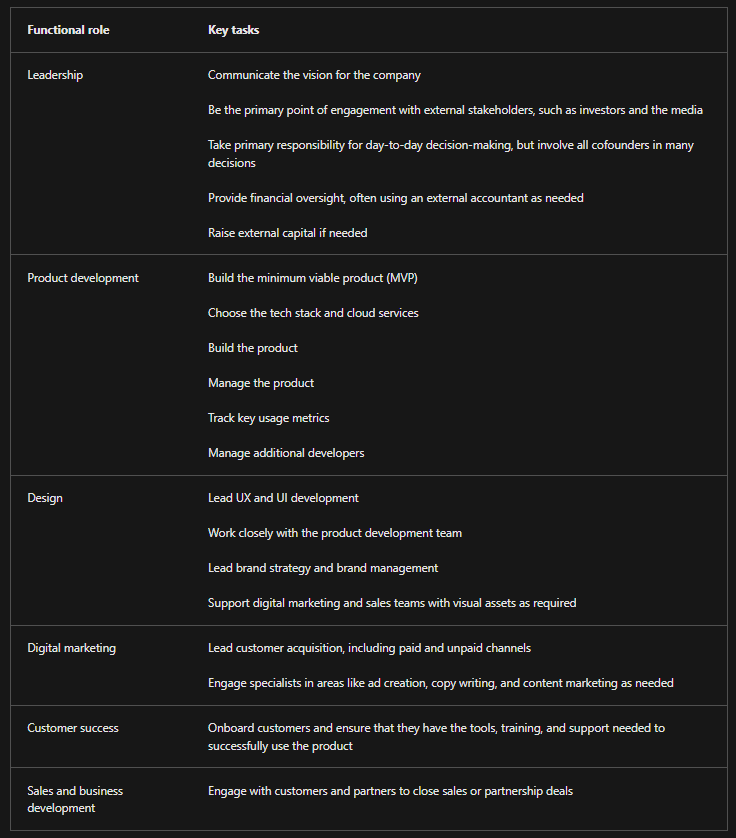

###Key Roles in a Startup:

###Risk Management:

- >

Cofounder Conflict: Disagreement among cofounders can lead to a breakdown in working relationships. If this breakdown isn't addressed, it can cause startups to fail.

- >

Vesting of Founder Shares: Despite your best efforts, it's possible that you or one of your cofounders will decide to leave the company. Departure of a cofounder in the first few years of a startup is surprisingly common. It can happen for many reasons, including financial pressures or disagreements between founders. To address this problem, startups frequently adopt founder vesting. That is, each founder earns equity over time, contingent on their ongoing involvement and performance.

Founder vesting has two components:

- >

Cliff: A cliff is typically a one-year period from the date of incorporation in which none of the founders have any vested shares. At the end of the year, assuming that each founder has remained involved, 25 percent of their shares will vest.

If a founder departs within the first year, they forfeit all of their shareholding. This makes sense on the basis that in most startups, not much value is created in the first year.

- >

Monthly vesting: The remaining 75 percent of each founder's shareholding is vested in equal installments over the following three years.

###Investment:

At its most basic, raising money from investors means to sell a stake in your company in return for cash. The investor obtains an economic interest in your company. They also gain some degree of control by virtue of the rights attached to their stake.

###Bootstrapping vs. External Funding:

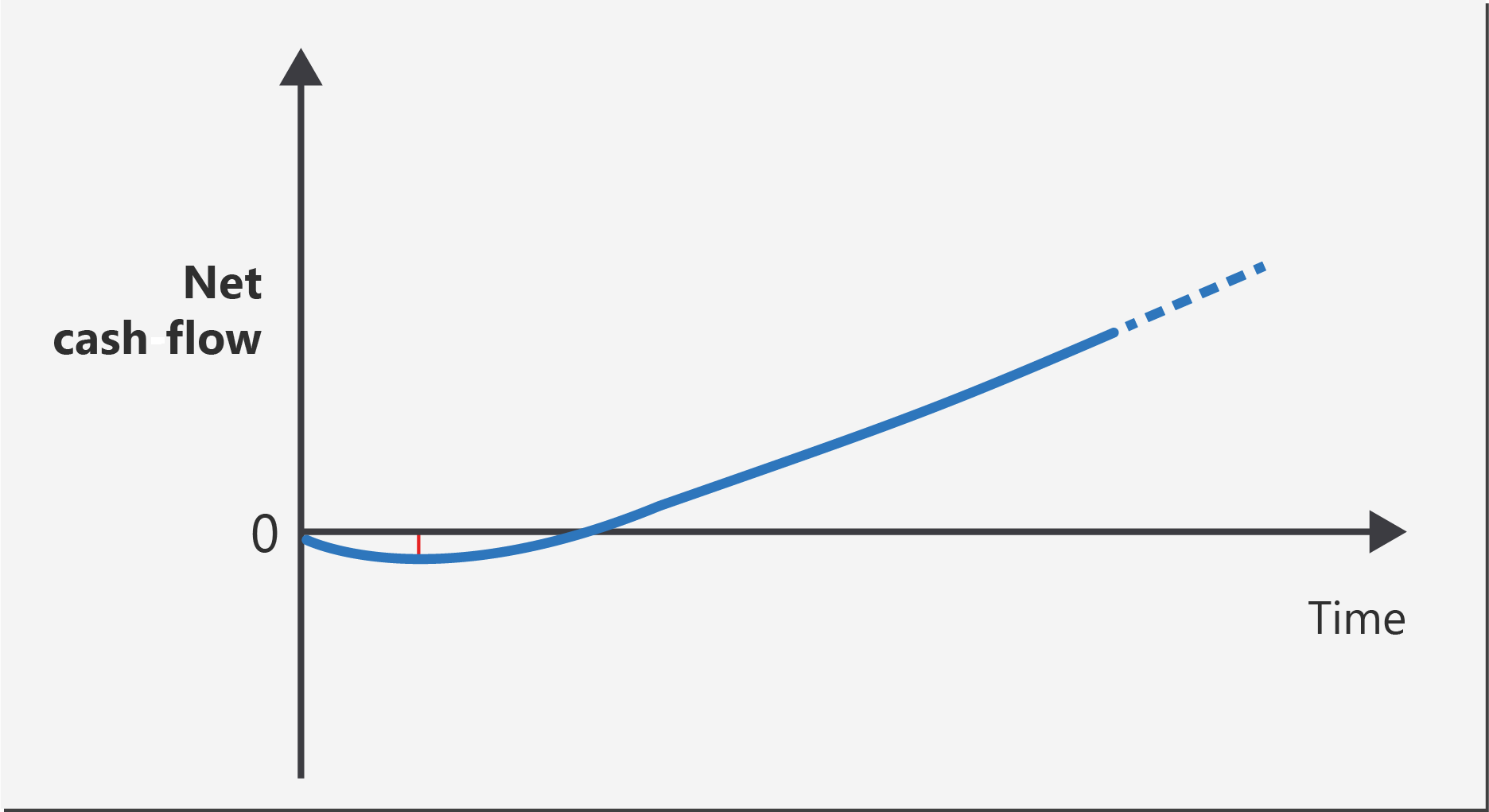

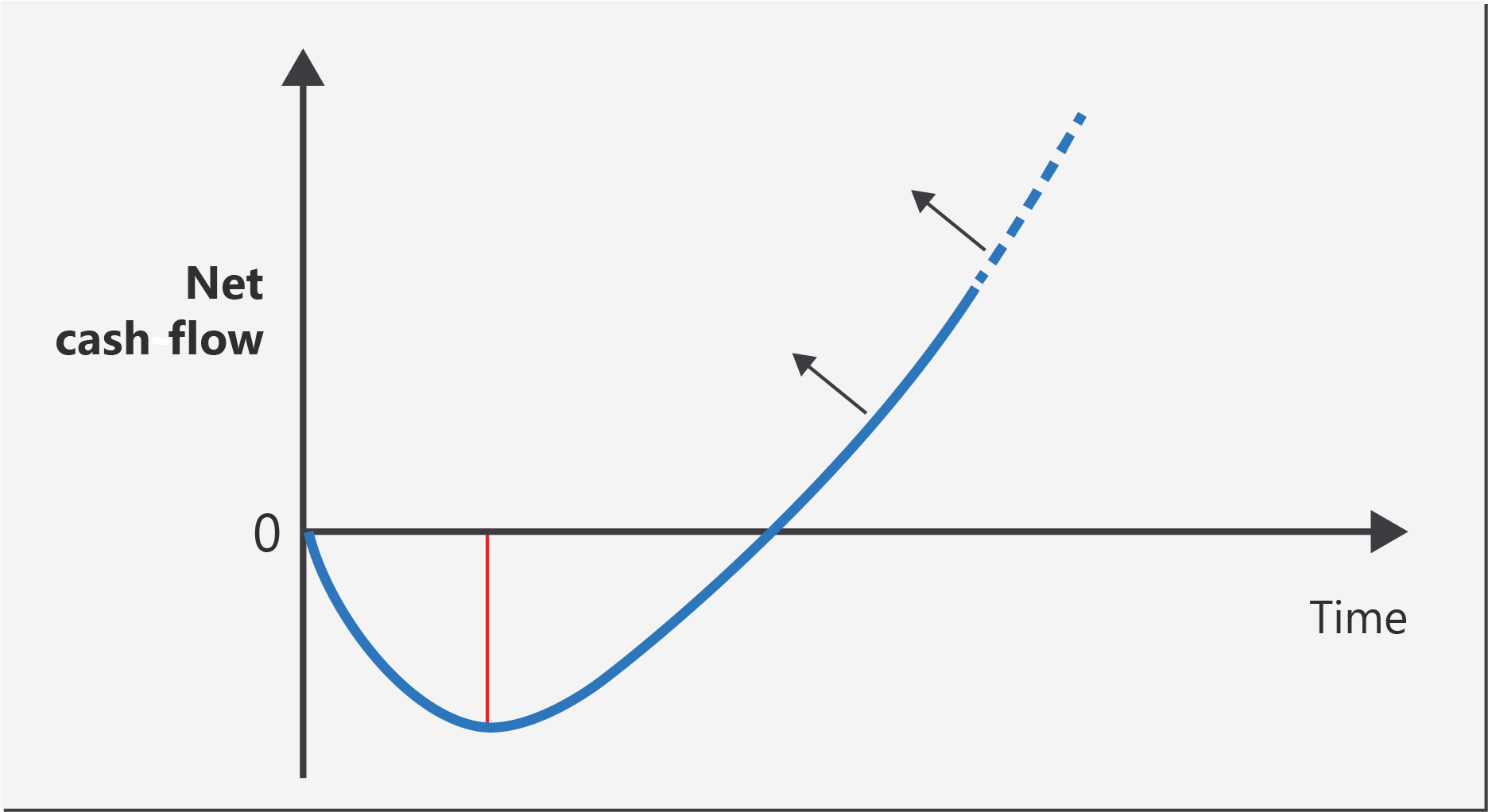

The difference between a bootstrapped company and an externally funded one can be seen in the following two charts, which show net cash flow over time.

Bootstrapped -

External Funding -

###Types of Investors:

- >

Friends and Family: It's common for startup founders to raise their first funding round from friends and family members.

- >

Angel Investors: An angel investor is a wealthy individual who invests their own money, like Melanie as an example.

- >

Venture Capital: VC funds are professional investment firms managed by general partners who have often been successful entrepreneurs themselves.

###Principles of Pitching:

- >

Why are you pitching?: Every time you deliver a pitch, you should have a clear purpose in mind.

- >

Who's your audience?: The most impactful pitches are delivered at just the right level for the audience. By understanding your audience's objectives and their current level of knowledge about your company and sector, you can deliver a pitch that's informative without being condescendingly simple or overloading them with unfamiliar terminology.

- >

Pitch Formats:

- >Elevator pitch: An elevator pitch is a short, pithy description of your company.

- >Demo day pitch: Demo day pitches generally have a firm time limit, allow for a small number of PowerPoint slides, and might or might not allow time for questions from a panel at the end.

- >Video pitch: Many accelerators and other startup programs require a short video pitch as part of their application process. These pitches vary in length, but 60 to 90 seconds is typical.

- >

Pitch Decks:

- >Presentable Deck: A presentable deck is the one that you'll use when you deliver your presentation either in person or online.

- >Readable Deck: Many angel groups and venture capital funds ask founders to submit a pitch deck online before they'll consider inviting you to present.

- >

Executive Summary: It's useful to write a one-page executive summary that complements your pitch

deck. Your executive summary should cover the following sections:

- >Your company mission

- >The problem you're solving

- >The product or service you offer

- >Your target customers

- >Your business model

- >Your competitive advantage

- >The status of your product or service

- >Your financial needs

- >Your team members